Raising your first rounds can feel like running an obstacle course blindfolded. As a founder who’s lived through bootstrapping several companies to raising angel, pre-seed, and seed funds for the first time, I want to share a playbook of hard-won lessons to help you navigate each stage. Think of this as founder-to-founder advice on how to run a strategic fundraising process from the spark of an idea all the way to a proper seed round.

Whether you’re gearing up to pitch your first angel or closing a seed round, this guide will break down each stage (Angel, Pre-Seed, Seed) with: purpose of the round, who to raise from, how to find the right investors, crafting your narrative & deck, building your funnel, and tactical tips + mindsets.

Are You Ready to be Venture Backed?

Fundraising isn’t meant for everyone—or every business. Before you step into the world of venture-backed startups, make sure the idea you're building is truly venture backable.

So what makes a startup venture backable?

Big Market Potential (a.k.a. “VC-sized outcomes”) VCs are looking for startups that can return the fund. That means your business needs the potential to scale into the hundreds of millions or billions in enterprise value. If you’re building for a niche market or aiming to be a lifestyle business, that’s perfectly fine—but it might not be VC territory.

Scalable Business Model Can your business grow fast without costs rising linearly? VCs want to fund high-margin, tech-enabled, repeatable revenue models—marketplaces, SaaS, platforms, etc. If you need to add 1,000 employees to make 1,000 more sales, it’s not scalable enough.

Clear Path to Moats or Defensibility Venture money fuels speed—but at some point, you need to build a moat. This could be network effects, proprietary data, a strong brand, switching costs, or tech IP. Without a path to defensibility, a fast follower can catch up quickly.

A “VC Story” You’re not just building a product—you’re telling a story. A venture-backable startup has a compelling narrative: This founder, solving this urgent problem, in this massive market, at this moment in time. Storytelling is how you differentiate when there’s a sea of startups pitching the same investors.

Team & Founder-Market Fit Investors back founders who are obsessed with the problem and equipped to solve it. You don’t need to have all the answers on Day 1—but you need to show you’re the right person or team to figure it out. That means credibility, focus, and relentless execution.

Speed & Traction Venture capital is designed to fuel hypergrowth. If you can show early traction or even just a fast-paced learning curve—shipping product, signing users, iterating weekly—it signals that your team can move fast with capital behind you.

If your business checks most of these boxes, then yes—you might be building something venture backable. But if not? That’s okay too. Not every company needs VC. Some of the best businesses are built without it.

Just make sure you know what game you’re playing—before you choose the investor path.

Before We Begin

For this guide to be useful, context matters. This isn’t theory. It’s the actual strategy we used to raise $2.5M+ at Shoppable Business—from Angel, to Pre-Seed, to Seed.

We’re building from the Philippines, where fundraising isn't the same as in SF or NYC. There's fewer investors, leaner valuations, and a different playbook. But if you’re scrappy, strategic, and relentless like me and my team—capital finds you.

Whether you’re a first-time founder or on your second or third rodeo, I wrote this playbook for you. Let’s get to work. 🚀

What's a SAFE?

This guide assumes that you are raising on a SAFE Note from Angel to Seed.

A SAFE note (Simple Agreement for Future Equity) is a financial instrument used by startups to raise early-stage funding. It was introduced by Y Combinator as a simpler alternative to convertible notes (which are basically short-term loans that convert into equity).

Here’s how a SAFE works in plain terms:

✅ How it works:

Investor gives money to a startup today, in exchange for the right to get equity (shares) in the future.

This equity is issued when the startup raises a priced equity round (like a Series A).

Unlike loans, SAFEs don’t accrue interest and don’t have a maturity date.

🧩 Key terms you might see in a SAFE:

Valuation Cap: The maximum company valuation at which the SAFE will convert into shares. (Good for investors—they get a better deal.)

Discount: A percentage discount on the price per share during the next equity round.

MFN (Most Favored Nation): If a better SAFE deal is given to later investors, early SAFE holders get that deal too.

Post-money vs. Pre-money SAFEs: Determines when the valuation cap applies (after or before the SAFE money is added in). Y Combinator now uses post-money SAFEs.

💡 Why startups like it:

Fast and simple to raise money without setting a valuation immediately.

No need to negotiate a full equity round or handle complex legal work.

🧠 Example:

Investor puts in $100K on a SAFE with a $2M valuation cap.

Later, the startup raises a priced round at a $10M valuation.

Because of the cap, the SAFE investor’s $100K converts into equity as if the valuation was $2M—not $10M—so they get more shares for their money.

FOUNDER TIP:

Safe: Valuation Cap, No Discount (Singapore) <~~~ The template we use, direct from Y Combinator

Our Backstory (Super Short Version)

Our Leadership team: Carlo, Sam, Chris, and Mark.

Together, we’re building Shoppable Business + Quotable AI, the leading end-to-end AI-powered supply chain platform in the Philippines. Think: Amazon Business of B2B sourcing for Southeast Asia + The Canva of Supply Chain Software.

We believe Southeast Asia businesses deserve Amazon-level supply chains. We're building the software and financial infrastructure to give every company — no matter its size — the speed, efficiency, and buying power of the world's largest enterprises, making the entire procurement and distribution journey seamless and invisible, so our customers can grow without limits.

We started with nothing but a conviction: that B2B buying and selling in Southeast Asia was broken, and someone had to fix it.

Here’s what we’ve raised so far:

😇 2022 Angel — $280K

💡 2023 Pre-Seed — $1.15M+

🚀 2025 Seed — $1.16M+

We've raised a total of USD 2.5M+ to date and we're on track to become profitable by the end of 2025. 🦓

We’ve pitched everyone—from friends, family, first-time angels to global seed funds. I've revised our deck more than the average startup and we've pitched to over 130 investors. We’ve made mistakes. And we’ve learned exactly how to tell the right story for each stage.

That’s what this playbook is about. A founder-to-founder manual to help you raise smarter, faster, and more strategically.

With that said, let’s dive in! 🚀

😇 Angel Stage – The First Believers (Stage 1)

This is where it all begins: your Angel round is about turning your idea into reality with the help of first believers. Angels typically invest very early, often when you have little more than a concept or prototype. Here’s how to ace this stage:

Purpose of an Angel round: Grab that initial capital to build an MVP and prove basic assumptions. It’s about funding the search for product-market fit – building v1.0 of your product, hiring one or two key team members, or validating that people actually want what you’re building. The goal isn’t scaling; it’s figuring stuff out (and not starving while you do it).

Who to raise from (and why): Angel rounds usually come from venture builders or individuals – think successful founders, industry executives, friends & family, or former colleagues who believe in you. These folks write personal checks (anywhere from $1K to $100K+) to back founders they trust.

SEA Valuation Range: $250K-$2M+

In our case, we were able to get our first tranche of initial funding from a venture builder we joined called AHG Lab. I was referred to AHG by another VC I pitched to back in 2021. I met one of the Co-Founders of AHG Lab and we hit it off, he said, "Carlo, what do you really want to build?" I told him my dream was to build an eCommerce Marketplace, because that's what I know well and that's what I have been doing most of my life. He believed in me as an entrepreneur and wanted to back my dream, 3 months after getting to know each other, AHG agreed to fund our idea. Our original idea was to build an Amazon type consumer marketplace for the Philippines, however we scrapped that idea as there were bigger problems to solve in B2B.

We used the initial funding to build both the supply and demand sides of the marketplace, and to develop our prototype using open-source software that we could fully customize for our B2B needs. This approach was significantly faster and more cost-effective than building an MVP from scratch. Later, we replaced the prototype with our own technology—what eventually became v2.0 of our managed marketplace platform.

Once we had a proto-type, we raised another tranche of funds from high profile strategic Angel Investors (Individuals) that understood our space and a local VC. We limited the the tranche to control our dilution.

FOUNDER TIP: Limit each round to 10%-20% dilution, as a team, you need to own 50% or more after your Series A, anything less VCs won't invest in your Series A round. For example, raise $100K-$150K on your first tranche to set a valuation cap, and raise another $100K-$150K on your 2nd tranche at a higher valuation. By setting a valuation cap, you are telling the market what you are valued at. Can you do multiple tranches in the same round? Yes, its possible! Which is why a lot of startups prefer to raise on a SAFE in the early stages. I will explain more about this later in detail when we reach the Seed section.

Lastly, as a founder, you’ll want to retain as much ownership as possible before an eventual exit. That’s why it’s critical to manage dilution carefully early on—if you don’t, you’ll regret it later. I use a custom tracker I created with the help of our investors that maps out every round we've raised and models future rounds, so I can see exactly how ownership changes over time. It's been one of the most valuable tools in staying on top of our cap table strategy.

Why angels? Because at this stage, they bet on you and your team, not the metrics. Look for people who:

Know you (or your team) and have seen you execute before, or

Understand your space deeply and get why your idea could be big.

FOUNDER TIP: If you don’t have a ready network of wealthy friends, uncles, or ex-bosses to invest, consider reaching out to local angel investor networks, venture builders, or startup incubators. These organizations can provide mentorship, access to their network, and—of course—capital. We didn’t have a strong investor network when we started. In fact, this was my first time raising funds from investors—I had always bootstrapped my previous companies. Joining AHG was one of the best decisions we made. They opened up their network, and we were able to successfully raise one of the largest pre-seed rounds in the Philippines at the time.

How to identify the right angels: Start with your own network: friends, family, alumni groups, ex-colleagues, that VP from your last job who now invests on the side. Also, ask existing angels for intros to other angels (they often roll in packs). Online tools can help too – e.g., Angel Investor Groups, LinkedIn (search “[Industry] angel investor”), or Crunchbase to see who invested in similar startups. The “friends of friends” route is golden: a warm intro beats cold emailing 100 random people. Focus on angels who have interest or expertise in your domain and a history of investing early. These are the people most likely to “get it” and add value beyond money.

Here's a list of Angel Investor Organizations in Southeast Asia. These same organizations invest all the way up to Series A depending on the group:

Here's a list of active independent venture builders in the Philippines:

Narrative & pitch deck essentials (Angel):

The Vision & Problem: What big problem are you solving and why it matters. Get your angel excited about the mission.

Team: Why you (and your co-founders, if any) are uniquely positioned to crack this problem. Highlight relevant experience or just pure passion/drive.

Solution (Prototype/MVP plans): If you have a demo or prototype, show it! If not, articulate what you plan to build with their money. Keep it simple and visual if possible.

Market & Potential: Paint the picture of the opportunity size (even if it’s a rough sketch). Angels know it’s early, but they want to see that this could be a venture-scale idea someday.

Early validation: Any little proof helps – e.g., “I spoke to 20 potential customers, and 15 said they’d use a product that does X” or a pilot user, LOI (letter of intent), etc. This shows you’re out of the building and testing the waters.

Basically, your pitch at the angel stage is selling the dream and you and your co-founders. Keep the deck light, story-strong, and be ready to pitch without one if needed.

Building and managing your funnel: Even for an angel round, treat fundraising somewhat like sales. Make a list of, say, 10-30 potential angel targets (the number can be small since each check might be smaller and you may not need too many). Write them down in a simple spreadsheet or use an investor CRM tool (more on tools in a bit). Include columns like:

Fund Name

Investor Name

Investor Role

Verticals

Type (Angel/Family Office/Micro-VC/VC)

Investment Stages (Pre-Seed/Seed/Series A)

Check size potential

Status (lead/pitched/diligence/won/lost)

$ Committed

Email

Phone #

Linkedin

# Of Meetings

Referred by

Last Contact

Notes. Start with your top choices first (those most likely to say yes or add value).

Leverage introductions: get mutual connections to introduce you; it dramatically increases hit rate.

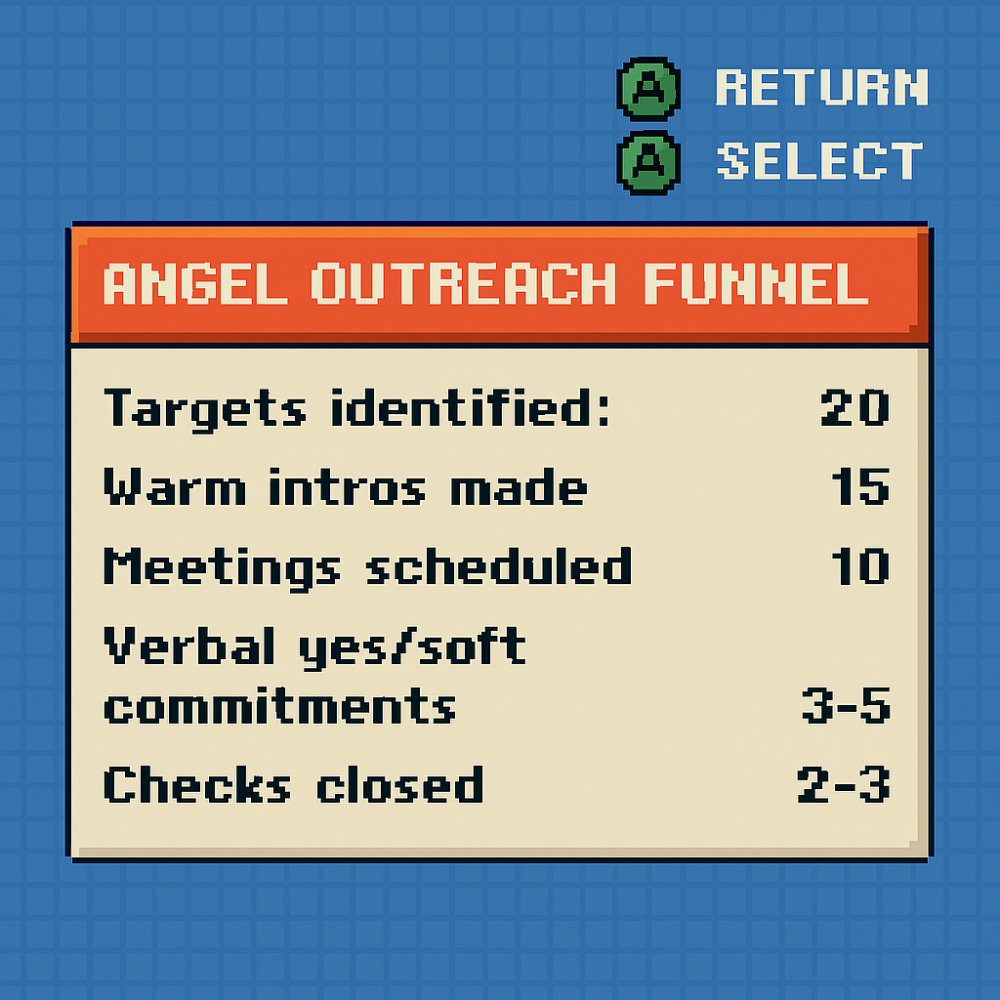

Keep track of where each investor is in your “pipeline.” For example:

Don’t be afraid to have many investors in “maybe” status – angels often bandwagon once someone credible commits. Keep the funnel moving by following up politely and sharing progress.

Tactical tips & founder mindset (Angel): This early round can feel very personal. You’ll likely face a lot of “I’ll pass, but keep me updated” responses. Stay resilient and remember: all you need is a few yeses to get going. Some tips:

Leverage FOMO carefully: If one angel is in, (subtly) let others know that momentum is building. Angels love to know others are interested – nobody wants to miss out on a hot deal among their peers. If you have a high profile angel that is well known, mention their name to the other potential investors that they've committed. This will increase conversion rate.

Be transparent about risks, but confident in your plan: Angels know it’s early; you build trust by saying “Here’s what we don’t know yet and plan to figure out with this funding.” Confidence ≠ over-promising. It means acknowledging the unknowns but showing you have the grit to tackle them.

Keep it informal and relationship-driven: An angel round might close on a handshake or a simple SAFE note. Focus on genuine conversations, not just transactions. One of our first angel investors told me he invested because “I believe in you and the team, and I know you’ll hustle until this works.” That relationship aspect is key.

Mindset: Think of angel money as rocket fuel for experiments. Use it to hit a milestone that makes you attractive for the next round—like building your MVP or signing your first customer. Also, choose angels who believe in the long game—they’ll be your support system when things inevitably get tough. Don’t be afraid to ask friends and family for support. If you’re confident that you can deliver and you show it, they’ll most likely invest. But you’ll never know unless you ask.

🎯 Angel Stage in a nutshell: Raise just enough to test your idea, lean on people who believe in you, and lay the groundwork for a story you can enhance at pre-seed.

Pre-Seed Stage – Proving the Potential (Stage 2)

Congrats, you’ve got a prototype or at least a clearer vision! The Pre-Seed (often overlapping with “angel round” in terminology) is about validating your solution and building momentum. This round bridges the gap between an idea and a product-market fit in progress. Here’s how to navigate:

Purpose of the Pre-Seed: Whereas angel money gets you from idea to initial product, pre-seed funding is about iterating to find traction. Use this round to refine your MVP, secure early users/customers, and ideally get to the point where you can demonstrate some product-market fit indicators. It’s the capital that helps you prove the concept in the real world. By the end of your pre-seed, you want to show that your startup has a heartbeat – real users, maybe revenue or usage growth, and a roadmap to scale. For us at Shoppable Business, our pre-seed let us build out the platform and onboard our first wave of business customers, validating that there’s real demand for what we’re building.

SEA Valuation Range: $2M-$5M+

Who to raise from (and why): Pre-seed investors can be a mix of angels, “micro-VC” funds, accelerator programs, government startup programs (equity free), or even small venture firms that do early bets. In fact, this stage often blurs with an angel round – many pre-seed rounds include multiple angels pooling together (sometimes via an Angel syndicate or rolling SAFE notes). We had an oversubscribed pre-seed at Shoppable Business, co-led by two early-stage VC firms, Foxmont and Seedstars, (both specialize in early stage investments) and supported by a global network of strategic angel investors. That mix is ideal: you get the speed, network and mentorship of angels plus the structure and networks of VC firms.

Look for Seed funds or micro-VCs that explicitly invest in pre-seed/seed in Southeast Asia (they’ll often write $100k-$300k checks). These funds bring credibility and can follow-on later if things go well.

Here's a list of early stage VCs that invest at pre-seed in the Philippines and SEA:

Accelerators or incubators: If you haven’t already, a top accelerator at pre-seed can provide a stamp of approval + a small investment. They can also be a stepping stone to a seed round by Demo Day. (Accelerators aren’t mandatory, but if you’re struggling to find lead investors, they’re worth considering for the network.) Note that some accelerators also have a VC arm.

Ideaspace Ventures

Seedstars

AppWorks

Strategic angels: e.g., future customers or industry executives who could open doors. Angels with domain expertise (they can advise on product and intros to clients). We chose angels who could potentially become partners or customers in our platform. Smart money > dumb money.

Government Startup Programs: If you're building from Southeast Asia—especially in emerging markets like the Philippines—you should absolutely look into government-backed startup programs. They’re one of the most underrated sources of non-dilutive capital, mentorship, and launch support.

These programs are designed to help founders go from idea to prototype to launch, without giving up equity.

If you're a Philippine startup, you can connect with a local technology incubator like Benilde HIFI to get support and guidance on how to apply.

In the Philippines, two key programs to know:

Startup Grant Fund (SGF) – DOST-PCIEERD

Run by the DOST PCIEERD, Innovation Council, the Startup Grant Fund provides up to ₱5M ($90K) in non-dilutive funding to early-stage startups focused on innovative, science and tech-driven solutions. It’s designed to help you go from prototype to product-market validation.

If you’re building in deep tech, enterprise SaaS, AI, climate tech, or health tech, this is one of the best ways to get early traction without giving up equity

TECHNiCOM – DOST-TAPI

Technology Application and Promotion Institute, run by DOST-TAPI, is a pre-commercialization grant program that supports the commercial viability of tech-based R&D outputs.

Startups can receive up to ₱10M ($181K) in grant funding to accelerate product development, cover prototyping, IP protection, market validation, and even early go-to-market activities. The program is ideal for university spin-offs, R&D-led startups, or tech founders working on breakthrough innovations that need serious funding to bridge the gap between lab and market.

Both programs are non-dilutive, meaning you don’t give up equity—and that’s rare in the early days.

The reason you want a healthy mix is that pre-seed is still very early for big VCs, but you might snag one or two forward-looking funds. They’ll guide you on metrics to hit for seed, and angels will keep you scrappy and grounded.

Identifying the right pre-seed investors: Much like the angel process, start with research and intros. Some tips:

Leverage your angels – ask existing angel backers if they want to put in more or if they’ll intro you to others. Success is contagious; an angel who put in $25K earlier might up their stake or bring a friend now that you have progress. Some of our angels who came in our pre-seed, put more money in our seed round and they referred several other investors. Make it easy for angels to invest with a low minimum, we were accepting $10K tickets from strategic angels, those same angels have added a ton of value by referring customers and suppliers.

Target micro-VCs: These are small venture funds (sometimes called pre-seed funds) often run by ex-founders. They typically invest at idea/pre-revenue stages but with a thesis (e.g., B2B SaaS-focused fund, or a fund for your geography). Use Crunchbase or VC lists (Twitter, LinkedIn) to find funds that did pre-seed rounds in your domain. Look at who funded companies similar to yours when they were at your stage.

FOUNDER TIP: Make sure the VC you're talking to actually invests at the pre-seed stage. A lot of VCs say they do, but what they really mean is: “Let’s see if you get some traction—then maybe I’ll take a second look.” It sucks, but that's the reality of fundraising. This happened to us, we even got a term-sheet only for them to back out last minute. Don’t waste cycles pitching VCs who are just “tracking” you. Focus your time on those who write checks before the traction is obvious and are actually taking the time to get to know you as a founder. I found that the early stage investors who do invest, actually take time to get to know you as a person, and this means a couple of meetings and hours of their time invested. At pre-seed, there's not going to be much traction yet, so investors are betting that you can execute your idea and vision and that you will make it to the next stage.

Use platform tools: There are tools like e27, and OpenVC, where you can filter investors by stage and industry and even request intros. Also, LinkedIn once again – search for keywords like “Investor | Pre-seed | [Industry]” or check profiles of founders in your space to see who backed them early.

Look locally and globally: Don’t underestimate local angel networks or funds in your city, but also consider that some international funds might invest in you if you fit their niche. In our case, a Switzerland-based fund (Seedstars) co-led our Philippine startup’s pre-seed round because emerging markets B2B was their specialty. I met Seedstars at a local startup event. Know your pitch angle for each investor – e.g., to a local investor, emphasize how you’re tapping a home market opportunity; to a sector-focused investor, emphasize your tech and market size globally.

Narrative & deck essentials (Pre-Seed):

Progress/Traction: What have you accomplished since the angel round? Show user growth, revenue (if any), product development milestones, or other KPIs that indicate momentum. Even small numbers count if they’re trending up or you learned something significant. Eg: “MVP launched in Jan; 100 pilot users onboarded by March with 20% week-over-week growth in transactions.” Make the case that you’re moving quickly and learning.

Product Demo: At pre-seed, you ideally have a working product. Include screenshots or a 1-minute demo video/gif (if pitching live, do a quick demo). This makes it real. If not fully built, show prototypes or a very clear product roadmap.

Business Model & Early Metrics: Create financial projections, and explain how you’ll eventually make money (if you haven’t started monetizing) and highlight any early revenue or usage metrics. Investors at this stage want to see that the dogs are eating the dog food, so to speak – some evidence of demand. If you have notable customer wins or letters of intent, call those out.

Team additions: If you’ve brought on a great CTO or another co-founder since the angel round, brag about them. A stronger team de-risks the venture.

Use of Funds & Milestones: Clearly state what this pre-seed money will help you achieve. For example: “This $500K will allow us to reach 10K users and $X in revenue, proving out our unit economics ahead of a Seed round.” Essentially, show that you have a clear plan for how the capital will drive key value-inflection points. Lastly, break down how the funds will be allocated—e.g., 40% to tech, 40% to operations, and 20% to sales and marketing.

The narrative now shifts from pure vision (“we have a dream”) to vision + evidence (“we have a dream, and here’s proof people want it”). Pre-seed investors still buy the big picture, but they also want to see that you’ve de-risked things a bit since the last round.

Funnel building & management (Pre-Seed): The funnel here will likely be broader than your angel round. Instead of, say, 20 targets, you might be reaching out to 50+ potential investors (since each may still only put in $50K-$250K, and you might be raising $500K-$1M total). It’s time to get organized:

Create a CRM for investors: If you haven’t yet, this is when a proper system helps. You can use simple tools like Excel or Google Sheets with columns for Stage, or a sales CRM like HubSpot (Startup Free) tailored to fundraising. The goal is to track dozens of conversations without dropping the ball. I personally used a Google Sheet as its cheap and gets the job done. Use whatever works for you, but track everything.

Top of funnel sourcing: Build a long list of targets. Include angels from angel stage who passed but said “keep me updated” (now you have progress to show – they might bite this time), new angels, micro-funds, accelerator partners, etc. Aim high as well – include a few well-known seed funds or VC partners; even if they say no, you might get feedback or a future Series A contact.

Stagger your outreach: Don’t ping all 50 at once. Start with a smaller batch to practice your pitch and gauge response. Refine your approach, then reach out to more. This way, if early pitches fall flat, you can tweak your deck/story before burning through your whole list.

Keep the funnel warm: Send periodic updates to all prospects you’ve engaged (like a concise monthly or quarterly update email: “In April we hit X users, launched Y feature. Now raising $___ to scale further; let me know if you’d like to catch up!”). This keeps folks who said “later” in the loop and often re-engages them. I sent out regular progress emails – some investors who were cold initially came around after seeing 2-3 updates showing we delivered on what we said.

Expect a lot of polite “no’s” or radio silence at the top, but all you need are that handful of yeses at the bottom of the funnel.

Tactical execution tips & mindset (Pre-Seed):

Storytelling + Numbers: Pre-seed is a story-driven sale backed by early numbers. Balance your pitch between vision (why this can be huge) and traction (why we’re not just dreaming; we’re doing). Be ready to dive into metrics if asked (churn, acquisition cost, whatever is relevant), but don’t lead with spreadsheets. Lead with excitement and possibilities supported by evidence.

Leverage momentum and social proof: If a well-known angel or a reputable fund commits, use that as momentum. It’s okay (and encouraged) to mention, “We’re excited that [Notable Angel/Fund] just came on board.” Social proof eases others’ fear of being first. That said, always ask permission if you plan to name-drop an investor in conversations. Usually framing it as “X is on board” once they’ve signed a SAFE is fine.

Stay scrappy with spend: You likely raised a modest amount at angel, and pre-seed might still not be huge. Demonstrate that you’re using funds efficiently. Investors love to see that $100k got you to a prototype and a signed pilot customer. It gives them confidence that with $1M you’ll achieve even more. Frugality = longer runway and leverage. (Internally, we treated our pre-seed like it had to last forever; we kept team super small and focused on proving key assumptions before hiring more.)

Founder mindset: This stage can be the toughest because you’re proving yourself. Be coach-able yet convicted – take feedback from investors on what they need to see (“we wish you had X traction or Y product feature”), and then actually execute and follow up. Every “not yet” is a chance to come back in a few months with “we did it – how about now?”. I approached our “no’s” as “challenge accepted.” Some turned into yes later. Keep a learning mindset rather than taking rejections personally.

Keep building, not just pitching: Unlike a big Series A where you might pause everything to fundraise, at pre-seed you and your team must continue making product and biz progress while fundraising. It’s a juggling act. Carve out time for both. Investors will be impressed if, between two meetings, you’ve shipped new code or closed a new logo. It shows relentless execution.

Cap table and terms: You’re likely using a SAFE or convertible note at this stage—simple and quick. Keep the valuation cap reasonable: high enough that you're not overly diluted, but not so high that it scares off future seed investors. Valuations can vary widely, but for reference, many pre-seed rounds fall in the ~$2M–$5M+ cap range, depending on location, team, and hype. Focus on getting the right people on board and raising enough capital to hit meaningful milestones—rather than trying to squeeze out the highest valuation possible. A clean cap table with supportive investors is far more valuable than chasing vanity numbers. Also, make sure your valuation isn't so high that you can't grow into it by your next round. The last thing you want is a down round. We've managed our rounds carefully so far, and our investors have already seen returns on paper.

FOUNDTER TIP: I’m a big believer in getting as many strategic angels on your cap table as possible. We were able to raise our pre-seed round thanks to angel investors. I pitched to friends, family, and even former customers I had helped in the past. I remember jumping on a Google Meet with a group of my high school friends from the U.S. I pitched them what I was building, and at the end of the call they said, "Carlo, we have no idea if this will work in the Philippines or not, but we know you and what you can do—and we don't want to miss out. So we're all in." Don’t be afraid to approach your friends, family, and former business contacts. Angels can add more value than you might expect—especially early on. Some investors worry about having too many names on the cap table. That’s okay. You can let them know that you'll group your angel and non-institutional investors into an SPV (Special Purpose Vehicle) before your priced round. This keeps your cap table clean and solves the “too many investors” concern before your Series A. Just make sure your term sheet includes a clause stating that investors will be rolled into a Special Purpose Vehicle (SPV).

🎯 Pre-Seed Stage in a nutshell: Prove that your baby is growing! Use this round to validate your product in the market, bring on a powerful mix of angels and micro-VCs, and set yourself up for a proper Seed with real traction and learnings.

🌱 Seed Stage – Scaling the Story (Stage 3)

Seed round: the big leagues of early-stage fundraising. This is where you transition from project to business. The Seed is typically a larger round (often $1M-$3M+ for many startups, though it can vary) aimed at scaling what’s working and positioning you for a Series A. I like to say the Seed is about “going from searching for product-market fit to executing on a proven model.”

Here’s how to run a strategic Seed process, integrating a playbook of tactics we used (from a killer strategy from founder Nick Raushenbush (How to run a strategic seed round process) modified for our startup, our market and lessons we’ve learned at Shoppable):

Purpose of the Seed round: In one word – ACCELERATION. By seed stage, you should have a product in market, early revenues or usage, and a line of sight to how this becomes a big business. The seed money is used to scale up: ramp user/customer acquisition, solidify the team (key hires), and hit milestones that Series A investors will expect (e.g. significant revenue, growth rates, engagement metrics). Essentially, the Seed round gives you 12-18 months of runway to find product-market fit at scale and prove that you can eventually be a $100M+ company. It’s also often about building enough traction that raising a Series A (a “priced round”) becomes possible. In our case, when we approach seed, we plan to use the funds to further develop our supply chain software Quotable AI, and continue to scale our managed marketplace model aiming to hit the metrics that Series A VCs want to see (like a certain GMV and revenue scale).

SEA Valuation Range: $5M-$12M+

Who to raise from at Seed (and why): At seed, you’ll likely target more institutional money while still including some angels. Typically:

Dedicated Seed Funds & Early-Stage VCs: There are VC firms whose sweet spot is seed stage. Some big name VCs even have seed programs or dedicated seed funds now. VCs often lead seed rounds with a sizable check (e.g. $300K-$1M from one fund) and will set terms if it’s a priced round, or take a large allocation on a SAFE. You want a lead investor who can not only write a big check but also has the network to help you hire and maybe even join your board (though note: many seed deals still use SAFEs, meaning no board seat.)

FOUNDER TIP: Don’t give away board seats so easily. Hold off on offering them until your Series A—unless you have a strategic investor who can add significant value by being on your board. As an alternative, consider offering a board observer seat, where the investor can sit in on meetings but has no voting rights.

Here's a list of VCs in the Philippines and SEA that are actively investing at Seed:

Foxmont Capital Partners

Seedstars

Buko Ventures

Plug and Play Tech Center

Kaya Founders

Ideaspace Ventures

AppWorks

A2D Ventures

FOUNDER TIP: When speaking with VCs, make sure they haven’t invested in any of your competitors. It’s a big red flag if they’re reaching out to you while already backing a competing company. Fundraising takes valuable time away from building, so it's important to learn how to filter which VCs that are actually a match for your startup. Over time, we learned to ask the right questions before taking any meetings—so we don’t waste each other’s time. Here are some questions you can ask:

Do you actively invest at my stage?

What check size do you usually write at this stage?

What sectors and business models are you most focused on?

Do you usually lead rounds or prefer to follow/co-invest?

Are you actively deploying from a current fund?

Do you invest in startups based in [Your Country/Region]?

Have you backed similar-stage companies in our space recently?

Before we meet—based on our stage and traction, are there any immediate disqualifiers from your side?

Micro-VCs and super-angels: Those who might have joined at pre-seed can still participate. Some smaller funds might follow-on, or notable angels might chip in larger checks at seed (say $10k-$100k each). They can fill out the round alongside the lead.

Family Offices: Often overlooked, family offices can be excellent seed investors—especially if they have exposure to your industry or region. They tend to be patient capital, value long-term relationships, and are less constrained by rigid fund cycles. Some are increasingly active in Southeast Asia’s early-stage ecosystem and open to direct startup investments.

Strategic corporate investors: These could be corporates or industry leaders who see alignment with your business and want early access, insights, or potential partnerships. Tread carefully here—strategic corporate capital can come with strings.

Accelerator follow-ons: If you went through an accelerator, some have follow-on funds or their partners’ funds that participate in seed rounds for alumni.

Venture Debt Providers (with warrants): If you already have some revenue or predictable cash flows, venture debt can be a useful complement to your equity round—especially if you want to extend runway without giving up more equity. Some venture debt providers offer loans alongside warrants, which give them the right to purchase a small percentage of your company’s equity at a fixed price and valuation. While the dilution is usually minimal (often <1%), it’s something to be aware of when negotiating terms. Venture debt isn't for everyone, but if you're already post-revenue and want to avoid unnecessary dilution, it can be a smart addition to your fundraising stack.

The why: By seed, writing a $1M-$2M check is beyond most individual angels, so you need funds. Institutional seed VCs bring structure, perhaps a board observer or formal advice, and often help you prep for Series A. They also reserve capital to participate in your next round, which is a good sign. You still want some angels or smaller investors who can be agile and hands-on, but the heavy lifting will be a VC firm that likely becomes your lead investor. Choosing your lead is crucial – ideally find one who shares your vision and believes in you, and whose partners have domain expertise or a track record of supporting companies through A and B rounds.

Identifying & targeting the right Seed investors: Now it’s an even bigger numbers game combined with a strategic game of chess. Some steps to identify targets:

Build a long list in tiers:

(1) Value-add Angels (individuals) you’d still love to include

(2) Micro-VCs/Seed funds (smaller firms, maybe <$5M funds or syndicates)

(3) Institutional VCs that do seed (larger funds with seed focus). Aim high but be realistic – target partners at firms who invest in your stage and sector. Use Crunchbase to see which funds led seed rounds for startups similar to yours in business model or industry. Also, check VC websites – many list their typical check size and stage. Make sure you find the right partner at each firm (e.g., the partner who loves fintech if you’re a fintech startup).

Leverage your network like never before: By now, you likely have a network: your angels and pre-seed investors can intro you to seed VCs. Ask for warm intros to your top targets. Many VCs also take cold pitches, but a referral will get you a meeting faster. Use LinkedIn and Twitter to see mutual connections. Don’t be shy – this is the time to activate mentors, existing investors, even other founders (founder referrals to their VCs are gold).

Use investor platforms and communities: Aside from Crunchbase, platforms like e27 (Optimatic), OpenVC, can help identify which investors are active. There are also databases like PitchBook , Traxcn, F6S for investor info. I often scraped LinkedIn and Google with queries like “seed investor Southeast Asia” to find news of who invested in companies like mine. It’s detective work, but each name you add is a potential ticket to funding.

Qualify your list: Not all money is equal. Research each target – have they invested in direct competitors? If so, likely a pass (or conflict). Do they only do $10M+ Series A rounds? If so, skip them for now or see if they have a separate seed program. Prioritize those who have a history of leading or co-leading rounds at your stage. Also consider geography – some funds only invest in US or Europe etc. Focus on those likely to be interested in your region if you’re not in a major hub.

Keep track of interactions: As you start talking to investors, track who is a good fit. For example, some VCs might show interest but drag their feet – note that. Others give a quick no but with feedback – incorporate that and circle back if relevant later.

In short, cast a wide net initially (it’s not uncommon to list 100+ seed investor targets), then focus in on the 20-30 that are most promising. At Shoppable, we've spoken to over 130 investors.

Crafting the Seed narrative & pitch deck: At seed, your pitch needs to level up. You’re now telling a story of momentum and market capture. Key things to nail:

Traction, Traction, Traction: This is the headline at seed. You must demonstrate that something is working. This could be revenue (e.g. $20k MRR growing 20% MoM), user base (e.g. 50,000 active users with high engagement), or any key metric for your business (GMV, bookings). Highlight retention and growth if you have them (e.g. “30% of our pilot customers have already made 3+ repeat purchases”). If you’re pre-revenue, then strong user growth or usage stats are critical. Basically, prove you have signs of product-market fit (or at least well on the way).

Market Size & Vision (revisited): Now that you have data, you can make an even stronger case for why this can be HUGE. Present a clear TAM (Total Addressable Market) analysis – show that you’re ultimately going after a billion-dollar opportunity. At seed, investors will scrutinize if your current traction can eventually tap a very large market. We articulate not just what Shoppable is today, but how it can expand into the broader B2B supply chain ecosystem (i.e., the big vision beyond the initial wedge).

Business Model & Unit Economics: Expect seed investors to ask “How will you make money sustainably?” and “What are the unit economics?” Include any data on CAC (Customer Acquisition Cost), LTV (Lifetime Value), gross margins, etc., if you have them in nascent form. Even if these are rough, it shows you’re thinking about how this becomes profitable at scale. If you don’t have enough data, outline the business model clearly and how you’ll monetize as you grow (e.g., take rate on marketplace, subscription fee, etc.).

Team: By now, it’s not just you and a friend in a garage. Highlight key team members and why you're the team to back. Also share in your pitch who you plan to hire with the seed funds (“We’ll hire 5 engineers and 2 sales reps to accelerate growth”). Investors bet on teams – so show you have A-players on board or lined up. If you have any notable new hires (say, a VP from a well-known company joined you), definitely mention that.

Competitive Landscape and Moat: At seed, you should address competition head-on. Who else is solving this problem, and why are you different/better? What’s your secret sauce or moat (tech IP, data, network effects, unique partnerships)? Seed VCs will have seen other pitches; show that you know the landscape and how you’ll win.

The Ask & Use of Funds: Clearly state how much you are raising (e.g. “We’re raising a $1M seed round to Scale The Company”). Also break down roughly how you’ll use it: e.g., 50% product/dev, 20% marketing, 30% ops – to reach XYZ milestones in 18 months. Show that this money gets you to Series A readiness (and outline what Series A readiness looks like: e.g., “with this seed, we aim to grow to $200k MRR and $1M ARR, which is Series A territory”). This assures investors that this is the big push that will set up a major next round, not just another small bridge.

Your deck should be polished, data-backed, and still convey the passion and vision that got you here. It’s a tougher balance: sell the dream, but back it up with data and a concrete plan. As a founder-CEO, your credibility in the seed pitch is crucial – you need to come off as the leader who will build a unicorn🦄, not just an excited startup founder. So refine your narrative, practice the tough questions (drill with your team or existing investors on Q&A), and be ready to defend every slide.

🎯Strategic Seed round process, step-by-step guide

How to use the SAFE to create leverage for a faster close

One thing that makes Seed rounds unique is the SAFE note (shoutout to Y Combinator for making it a thing) and how you can increase the “cap” (basically your valuation) to create momentum and FOMO.

More founders should be using this strategy to their advantage.

Step 1: Build your investor list and prep materials

Make that list of 50-100+ potential investors (across angels, micro-VCs, seed funds, bigger VCs). Fill in as much info as you can: partner names, thesis fit, connection angle.

Prepare a solid pitch deck and a short “teaser” blurb. Also have a one-pager or memo ready (some investors might prefer a Google doc or memo instead of a deck; we prepared both a one pager and an investor memo with more in-depth metrics and vision to send as follow-up). Reserve the memo for serious investors only and only send it out after the initial meeting.

Create an investor update email template you can reuse to send updates as you progress. Keep it ready for later steps.

Decide your target raise amount and valuation range. Many seed rounds use a SAFE note – consider using a SAFE with a cap. (More on a clever SAFE strategy below.) Also decide if you’re open to doing an equity round if a lead prefers that (some leads might offer a term sheet to price the round – be prepared by knowing what terms you’d accept).

Step 2: Warm up conversations (no hard pitch yet)

Start reaching out to investors on your list without immediately asking for investment. The idea is to gauge interest and build relationships. This can be as simple as: sending a friendly email or LinkedIn message that says “We’re not formally raising yet, but we’re exploring a seed round soon. Let them know about your startup's traction, target market size, and 3-4 metrics in bullet point form, keep it simple and straight to the point.”

Take an initial call with all of the investors that are interested, flip the script: ask them questions too – like what do they look for at seed, how do they prefer to work with companies, etc. This not only gives you info, it makes them feel involved early rather than being hard sold. Share your vision, some impressive traction points, and that you’re considering raising seed. You might say something like, “We think we could scale faster with outside capital, so we’re gauging interest among a few investors while we keep crushing our milestones.” (Subtext: we’re being selective and not desperate.)

After each call, send a thank you email with a brief recap and maybe an “investor update” style memo attached. This could be a one pager PDF or Google doc summarizing your progress (key metrics, recent wins, product roadmap). This keeps them thinking about you. If any investor seems super eager and asks if you’re raising, you can say “We plan to kick off the round in [upcoming month], I’ll definitely loop you in when we do.”

Essentially, you’re doing early marketing: creating a list of warm leads who are interested but not yet formally in a process. This way, when you do kick off the raise, it won’t be cold – you’ll have folks to update who already know you.

Step 3: Decide on 2 caps and your allocation amounts for the SAFE note (Timeline: just before officially raising)

Divide your round into two tranches, each with a different valuation cap on the SAFE. It should look something like this

The idea: early investors get a better price (lower cap) as a reward for committing early; later investors pay a higher price (higher cap). This creates FOMO and time pressure: if an investor waits too long, the deal gets a bit more expensive.

You also plan a timeline around these tranches: e.g., Tranche 1 is only open for 1.5 weeks, then you raise the cap; Tranche 2 another 1.5 weeks, etc., aiming to wrap the whole round in a few weeks. This short timeline can motivate investors to act rather than dragging feet.

Important: Once you move to a higher cap, don’t ever go back down for someone. It’s bad form and unfair to your earlier investors. If you misjudge interest and can’t fill the round at the higher cap, you may need to renegotiate with those who came in at that cap—which gets messy fast. So set your caps realistically based on interest level. You’ll also need to adjust your caps and timelines according to your market and business dynamics—this strategy depends on a number of factors. And don’t feel bad if it takes you longer to close the round. The beauty of this approach is that it’s flexible: you can execute it in a few weeks or over a few months. Either way, if done right, it only works in your favor.

We used a mini version of this at pre-seed (inadvertently) by having some angels in earlier at a lower cap, then later ones at a slightly higher cap once we had momentum.

Step 4: Kick off the raise – Tranche 1 (Angels, Family Offices, Micro-VC funds)

Time to officially raise. Begin with those add-value angels and perhaps any existing smaller investors you want to give first shot:

Reach out personally to each, letting them know you’re now raising. Frame it with excitement: We got more interest in our round than anticipated, so we’ve decided to raise now. This signals that others are interested (social proof) and that this train is leaving the station.

Offer them the Tranche 1 terms (the lowest cap SAFE). Essentially say, “Because I really value what you could bring, I’d like to offer you a special allocation at a $X cap before we open it up to others at a higher valuation next week.” People love feeling like insiders.

Provide the deck, metrics, etc., and offer to answer questions or hop on a call. Some might commit just via email if they know you well; others might want a quick update call. Be responsive and facilitate whatever they need quickly – you’re on the clock.

Mention that this first tranche is limited (e.g., “$500K available at this cap”) and will likely fill up fast. But also be genuine: don’t pressure too hard; acknowledge if they need more time, let them know there’s another tranche coming, but at a higher cap (so they don’t feel like it’s now-or-never ultimatum). The subtle psychology is: now is better (cheaper cap), but if not now, you can still join later albeit at a higher price.

As checks start coming in, track commitments closely and get that money in the bank💵. Once you hit around ~70% of Tranche 1 filled, you can let any remaining investors in this group know “we have only ~$X left at the initial terms.” Sometimes that nudges them to jump in before it’s gone.

If all goes well, by end of the week you’ve got a chunk of your round done – awesome! Even if Tranche 1 ends up being just your existing investors topping up, that’s fine; money is money and it sets the stage.

Step 5: Engage institutional VCs (the big fish) mid-process.

You don’t wait until Tranche 1 is fully closed to start talking to the larger VC firms (those who could potentially lead or put in big checks).

Halfway through tranche 1, reach out to your top VC targets (the bigger funds). Let them know you’re in the midst of raising due to strong inbound interest. Mention specific momentum: e.g., “We’ve raised $350K of our seed in the last 10 days from great angels and family offices.” For VCs, hearing that the round is moving fast is a trigger – nobody wants to miss an opportunity that’s closing soon.

Request a partner meeting or investment committee pitch for the next week. For example: “We’d love the chance to present to your partners; we’re scheduling final meetings next week with a few interested firms.” This signals that they need to slot you in quickly or risk missing out. If they’re interested at all, they’ll make time.

By now you should also wrap up Tranche 1 commitments and let those investors know you’ll be moving on to VC discussions. Essentially thank them and subtly signal that the next stage is happening: “We’re now going to speak with a few institutional VCs for the remainder of the round.” This makes them feel even smarter for getting in early, and maybe a little curious about who the lead might be.

Step 6: Tranche 2 – Expand to VC funds & Close the Round

Now raise the SAFE cap to your Tranche 2 level (say from $5M to $7M cap in our example) and start bringing in the next wave and close your round.

Reach out to the VCs and any notable angels and other investors you haven’t yet. Use a similar approach: “we’ve decided to raise, we already closed $X in the first week from angels, now we’re opening up the last allocation at [$7M] Mentioning that you closed money quickly (e.g. “$500K in 1.5 weeks”) is huge social proof and creates urgency for VCs – it signals hot deal.

Concentrate your VC meetings tightly. Ideally, have all your pitches in the same week (if you have multiple interested VCs). This way, you can drive to a conclusion around the same time. Share the same data with all to keep things level.

Again, share deck, data, and offer calls. Many funds will want a partner meeting or deeper dive. Try to schedule all those meetings within a tight window (ideally the same week). You want to concentrate the interest; don’t allow a fund to say “we’ll talk next month” if you can help it – by then you intend to be oversubscribed! Politely let them know the timeline: e.g. “We’re aiming to wrap up this round in the next 2-3 weeks.”

Keep feeding FOMO: As you get interest, periodically update those on the fence with friendly notes like, “Just to keep you in the loop – we have $350K committed out of $500K in this tranche, and expect to move to close next week. Let me know if I can clarify anything to help you decide. This isn’t pressuring; it’s factual and reminds them that others are getting in.

Importantly, continue to update your Tranche 1 investors too, even if they’ve invested – they might refer other investors or even add to their check seeing momentum. Keep everyone excited about progress (“Now we’ve got XYZ Fund in, super exciting!”). Success breeds success.

If you get multiple offers or interest, good problem! You can choose the best fit. It’s okay to (tactfully) let your top choice know you have other interest: “We do have a couple of firms expressing serious interest – of course I wanted to circle back to you first since we’d love to work with [Firm].” This can prompt them to move. But handle this carefully; don’t lie about interest, and don’t create a nasty bidding war that drags out. You ultimately need to pick a partner and close.

Close the deal: Once you have a lead investor commit (or any remaining allocation spoken for), get the paperwork done ASAP (SAFE notes signed, or term sheet and legal docs if priced) and collect the funds. Then inform everyone else in your funnel that the round is closed or oversubscribed (thank them for their time, you might invite some smaller checks if you want to squeeze a bit extra, but don’t linger). Then CELEBRATE – you did it! 🎉 Back to building🚀.

FOUNDER TIP: Throughout the seed process, communication is your best friend. Keep people updated, create (authentic) urgency, and drive toward closure. A strategic process like the above can significantly cut down the fundraising timeline – sometimes to just a few weeks – which means less time fundraising and more time operating.

🎯 Seed Stage in a nutshell: This is your time to sprint. Run a tight process, leverage FOMO with an escalating SAFE strategy, and close your round before the momentum fades. Use the capital to triple down on what’s working and position yourself for the next big leap (Series A). You got this!

Summary

Fundraising from Angel to Seed is a journey of evolving your story, your strategy, and yourself as a founder. We went from scrappy pitches over coffee to running a structured process with multiple term sheets on the table. No matter where you are now – pitching your first angel or closing your seed – remember that each round has a purpose in your startup’s story. Stay focused on the purpose, target the right partners, and run a tight process to get the deal done.

Most importantly, believe in yourself and the value you’re offering. Investors can sense when a founder has that mix of passion and plan. Be that founder. 🙌

I hope this playbook helps you hustle smarter and hit your fundraising goals. If you found this useful, please follow me here on Substack for more founder playbooks and real-talk insights.

Good luck, and see you at the top!

🚀 If this helped you, it’ll help someone else too. Forward it to a founder or operator in your circle.

Thanks for reading Operator Insider: SEA Edition! Subscribe to receive new posts and support my work.